IonQ Stock Price: NVDA, QBTS, and the Quantum Computing Reality Check

Generated Title: IONQ: Quantum Leap or Quantum Hype? A Data Dive

The quantum computing sector, and IonQ (IONQ) in particular, continues to generate buzz. But hype and reality often diverge, especially in nascent tech fields. Let’s drill down into the numbers and see if IonQ's trajectory warrants the excitement, or if it’s just clever marketing masking fundamental challenges.

The Bull Case: Revenue Growth vs. Reality

Analyst Joseph Moore at Morgan Stanley recently raised IonQ's price target, citing expectations of a "solid revenue beat" and a "bullish outlook." Wall Street anticipates a 118% year-over-year revenue surge to $26.99 million. This sounds impressive, no doubt. But let's put that into perspective.

IonQ currently sports a $15 billion market cap. A $27 million quarter, even growing at 118%, hardly justifies that valuation. To illustrate, consider this: IonQ's revenue for the last 12 months sits at $52 million. Their operating margin? A staggering -700.6%. That means for every dollar of revenue, they're losing seven dollars. It's like trying to fill a swimming pool with a garden hose that has more holes than it does nozzle.

Moore cites technology development agreements with the UK, Korea, and Japan as a catalyst for IonQ's growth. These agreements, focused on quantum technology, are undoubtedly positive signals. However, translating these agreements into tangible revenue streams remains the crucial, yet uncertain, step. How quickly can IonQ capitalize on these partnerships, and at what cost?

IonQ’s competitors, D-Wave Quantum (QBTS) and Rigetti Computing (RGTI), are also loss-making, which might suggest it's simply an industry-wide phenomenon due to heavy R&D investment. Fair enough. But "everyone is losing money" isn't exactly a compelling investment thesis. The question then becomes: who will reach profitability first, and how sustainable will that profitability be?

Downturn Resilience: A Litmus Test

A critical factor often overlooked in high-growth narratives is "downturn resilience." How will IonQ perform when the market tide inevitably turns? The data here is concerning. During the 2022 inflation shock, IONQ stock plummeted 90% from its November 2021 high to its December 2022 low, vastly underperforming the S&P 500's 25.4% decline.

While the stock did recover, regaining its pre-crisis peak by November 2024, this volatility raises serious questions about its suitability for risk-averse investors. (And, frankly, any investor who isn't comfortable with a 90% drawdown should probably steer clear.) This begs the question, "Will the company be able to weather similar economic downturns in the future?"

The "Buy or Sell IonQ Stock?" report highlights this concern, noting that while historical data indicates price declines typically recover, the risk related to profitability and downturn resilience remains. The report also poses a crucial question: would you be able to maintain your stock positions if IONQ drops another 20-30%? It’s a question every investor should ask themselves before diving in.

And this is the part of the analysis that I find genuinely puzzling. The report suggests that the Trefis High Quality Portfolio has effectively transformed stock-picking unpredictability into consistent market-beating results. But is that truly relevant here? Comparing a highly diversified portfolio to a single, highly speculative stock like IONQ feels like comparing apples and rocket ships.

The Quantum Dream, Grounded in Reality

IonQ provides general-purpose quantum computing systems accessible through major cloud platforms (AWS, Microsoft Azure, and Google Cloud Marketplace). This accessibility is a definite plus, lowering the barrier to entry for businesses looking to experiment with quantum computing.

However, accessibility doesn't guarantee adoption or, more importantly, revenue. The fundamental challenge remains: demonstrating real-world applications that justify the cost and complexity of quantum computing. Until IonQ can consistently deliver tangible benefits to its customers, the stock will remain largely driven by speculation and sentiment, not by concrete financial performance.

So, What's the Real Story?

IonQ's potential is undeniable, but its current valuation is divorced from its financial reality. The company needs to prove it can translate technological promise into sustained profitability, and do so in the face of inevitable market headwinds. Until then, proceed with extreme caution.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

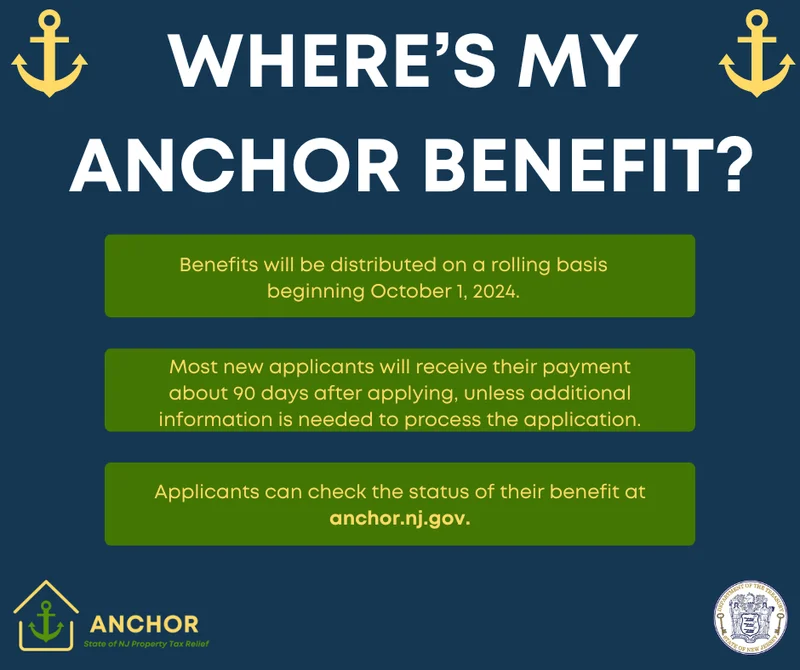

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)