ANyONe Protocol: What it is and the real story

The AI Agent Boom: Protocol AI's Bet on Web3 Democratization

The digital landscape, ever-shifting, just saw another seismic event from Dubai. Protocol AI, launching its platform on June 19, 2025, isn't just another entrant in the crowded Web3 space; it's making a bold play to fundamentally alter how decentralized applications are built. Their stated mission: democratize Web3 development, a revolutionary approach highlighted by Protocol AI Captures $16B AI Agent Market with Revolutionary Platform That Turns Anyone Into a Web3 Developer. A lofty goal, certainly, but one that lands squarely in a market segment currently experiencing exponential growth.

Let's talk numbers, because that’s where the real story often hides. According to CoinGecko's annual report, the on-chain AI agent market capitalization didn't just grow in Q4 2024; it exploded. We're talking a 300% leap, from a respectable $4.8 billion to nearly $16 billion. To be more exact, that's a 233.3% increase in just three months, and Protocol AI is clearly aiming to ride that wave. They’re stepping into an arena where the demand for intelligent, autonomous agents is no longer theoretical, but a quantifiable financial reality. This isn’t a slow burn; it’s a full-throttle sprint, and Protocol AI believes its "pAgents" are the vehicles to get everyone to the finish line, regardless of their coding prowess.

The core of their pitch revolves around these autonomous AI agents, "pAgents," which promise to let users conjure dApps, mini-games, and smart contracts using nothing more than plain language. Imagine telling an AI, "Build me a decentralized lending platform with these parameters," and watching it materialize. This isn't just a convenience; it's a direct assault on the traditional Web3 development bottleneck – the extensive coding requirements and lengthy development times that have, until now, limited innovation to a select few with highly specialized skills. It’s like moving from hand-coding every line of a website in HTML to dragging and dropping elements in a modern web builder, but for the infinitely more complex world of blockchain. The question, of course, is whether a drag-and-drop dApp can truly withstand the rigorous demands of security and performance that define robust Web3 infrastructure.

Unpacking the Mechanism: Vision vs. Execution

Protocol AI isn't shy about listing its innovations. An Instant AI dApps Builder, full compatibility with EVM blockchains (Ethereum, Base, BSC), AI ownership by a DAO via $PROAI token holders, and a Proof of Value system for transparent rewards are all on the table. They claim multi-language natural language input and deployment across major networks like Ethereum, Binance Smart Chain, Polygon, and Solana. This is an ambitious cross-chain play, aiming for broad accessibility from day one. AI-driven development assistants are also touted to autonomously handle contract generation, debugging, security auditing, and performance optimization. It's a comprehensive suite designed to cover the entire development lifecycle, theoretically reducing both the barrier to entry and the associated technical debt.

Security, a perennial concern in the blockchain space, is addressed through partnerships with auditing firms Coinsult and Solidproof, alongside vulnerability testing from Web3Toolkit and Web3Payments. These are reputable names, which is a necessary, though not always sufficient, first step. The real test will come when these plain-language-generated dApps are put through the wringer of real-world attacks. How does an AI interpret and secure against novel exploits when its primary input is a user's vision rather than a meticulously defined codebase? This is where the rubber meets the road, and where the promise of simplicity often collides with the unforgiving reality of blockchain security.

Looking ahead, Protocol AI’s strategy unfolds with platform optimization and developer onboarding in Q3 2025, major blockchain partnerships in Q4 2025, and then the big leagues: centralized exchange listings and institutional adoption initiatives slated for 2026. This is a standard, aggressive roadmap for a project with high aspirations, but I've looked at hundreds of these filings, and the leap from "developer onboarding" to "institutional adoption" in a single year often overlooks the monumental challenges of regulatory compliance, enterprise-grade scalability, and the sheer inertia of traditional finance. The ecosystem plans to generate revenue through $PROAI token marketplace transactions, direct sales, subscription services, developer royalties, and enterprise licensing for custom AI agent development. It’s a diversified model, which is smart, but the success of each stream hinges on mass adoption – a factor that remains, for now, a significant variable. The exclusive presale for $PROAI tokens is currently underway for early investors, which, in the absence of any public reaction data, means we're left to infer market sentiment solely from this early-stage financial activity.

The True Cost of "Democracy"

Protocol AI has launched into a booming market, armed with a compelling narrative about democratizing Web3 development. The vision of "pAgents" allowing anyone to build dApps with plain language is undeniably attractive, especially given the historical friction points of traditional blockchain coding. However, the elegance of the solution must be weighed against the inherent complexities of decentralized security and robust functionality. Can a system truly abstract away all the intricate, often counter-intuitive, details of smart contract development without introducing new vulnerabilities or limitations? The market growth for AI agents is a fact, a powerful tailwind. Protocol AI's ability to truly harness that wind, beyond the initial presale, depends on whether their "plain language" genuinely delivers secure, scalable, and innovative dApps, or if it merely provides a veneer of simplicity over an ocean of potential technical debt. The data shows the opportunity is immense; the execution, however, is where the real value—or lack thereof—will be quantified.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

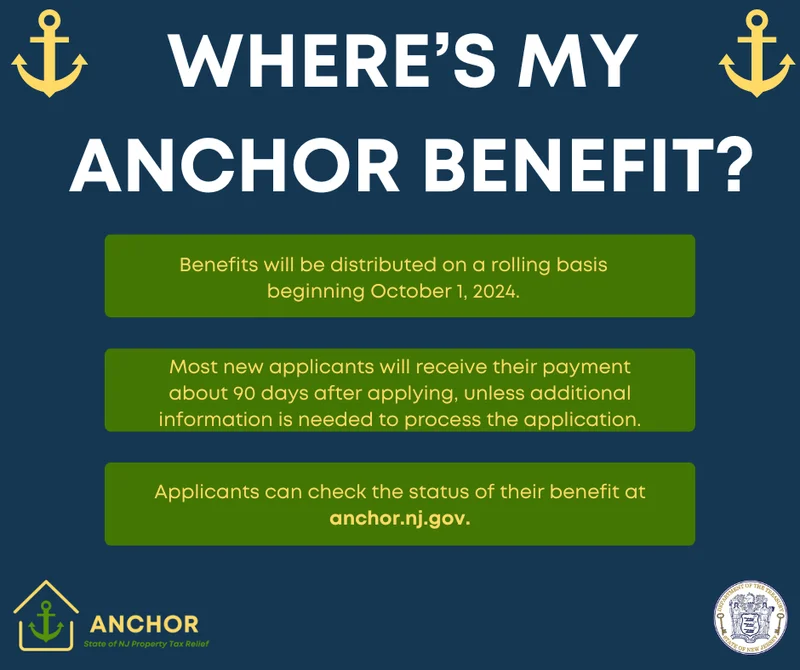

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)