CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

The CoreWeave Conundrum: A Tale of Two Narratives

Let's be clear: numbers don't lie, but they sure can tell different stories depending on who's doing the reading. CoreWeave (CRWV), a name that's been buzzing in the generative AI infrastructure space, just delivered a masterclass in market dissonance. You had solid Q3 earnings – "better-than-expected," in the parlance of analysts – but the stock cratered, as CoreWeave Stock Slides On Supply Snag, But Support May Be Near (CRWV). We're talking a 16.3% drop right out of the gate, and another 9% slide by the morning of November 11th. The market, it seems, heard "better earnings" and translated it into "panic sell."

Why the disconnect? A delay in a third-party data center buildout. This isn't some existential threat, mind you, but it did lead CoreWeave to slightly lower its 2025 revenue outlook. And that, apparently, was enough to send investors scrambling for the exits. It's like watching a marathon runner trip on a shoelace a mile from the finish line, and the entire crowd assumes they've broken both legs. The market is often a creature of immediate gratification, and any hint of a speed bump, no matter how temporary, can trigger an irrational flight. I've seen it countless times; the short-term traders hit the 'sell' button before the long-term implications are even fully digested.

But here's where the narrative fractures, and where things get interesting for those of us who prefer to look past the immediate noise. While the herd was stampeding, Morgan Stanley analyst Keith Weiss did something decidedly contrarian. He raised his price target on CRWV to $99 from $91. Hold on, you might say, didn't the stock just get pummeled? Yes, it did. And to be more exact, it was a 16.3% plunge following the earnings release, not some minor dip. This move by Weiss stands out even more considering "several other analysts lowered their price targets following the report." This isn't just a difference of opinion; it's a fundamental divergence in interpretation of the same core data.

Diving Deeper into Weiss's Wager

So, what exactly is Keith Weiss seeing that the rest of the market, and indeed, his peers, are missing? His rationale centers on two key points. First, "strong demand from top GenAI clients" confirms CoreWeave's strategic positioning. This isn't just speculative demand; it's tangible, high-profile interest. Second, CoreWeave is actively "reducing customer concentration risk" through deals with Nvidia and Meta. This means no single client now accounts for more than 35% of its revenue backlog. That's a crucial de-risking maneuver, a smart play that diversifies the revenue stream and reduces vulnerability to any one customer's shifting fortunes. It’s like a financial tightrope walker suddenly getting a safety net; the underlying act is still challenging, but the potential for catastrophic failure is mitigated.

However, even Weiss isn't entirely without caution. He noted that "consistent execution remains a challenge, especially when scaling GPU infrastructure in a constrained supply environment." This is a critical point, a methodological critique, if you will, of the underlying operational reality. Building out complex data centers and securing scarce GPU resources isn't a walk in the park. It's a logistical chess match, and delays, as we've just seen, are a real possibility. This isn't about CoreWeave's ambition or its market position, but about the grinding, difficult work of physical infrastructure deployment.

So, for Weiss, the short-term stumble is just that: a stumble. For long-term investors, particularly those who truly believe in the "GPU boom," he suggests this dip could be an "attractive entry point." The stock has already surged over 138% since its IPO in March, which tells you something about the underlying investor optimism before this recent shake-up. The Street, in aggregate, still holds a "Moderate Buy" consensus, with an average price target of $149.29, implying a substantial 68.9% upside. This suggests a majority of analysts are still bullish, even if some have trimmed their sails.

The Data's Unspoken Questions

This whole CoreWeave episode is a textbook example of how a single piece of news, even if it's about a future operational delay, can overshadow otherwise positive fundamentals. The market, in its immediate reaction, behaved like a startled gazelle, bolting at the first rustle in the grass, while Weiss, playing the role of the seasoned tracker, saw the larger migratory pattern.

But here’s what I'm still trying to parse out: If the demand is so strong, and customer concentration is down, how significant is a slight lowering of the 2025 revenue outlook, really? Is it a genuine red flag, or simply a convenient excuse for profit-taking after a massive post-IPO run? And what’s the true probability of these data center delays becoming a recurring theme, rather than a one-off hiccup? The difference between a temporary blip and a systemic bottleneck is profound, and the current data doesn't definitively answer which it is. My analysis suggests that the market might be over-indexing on the operational friction and under-indexing on the strategic positioning and demand signals. It’s a gamble, yes, but one backed by a compelling long-term thesis.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

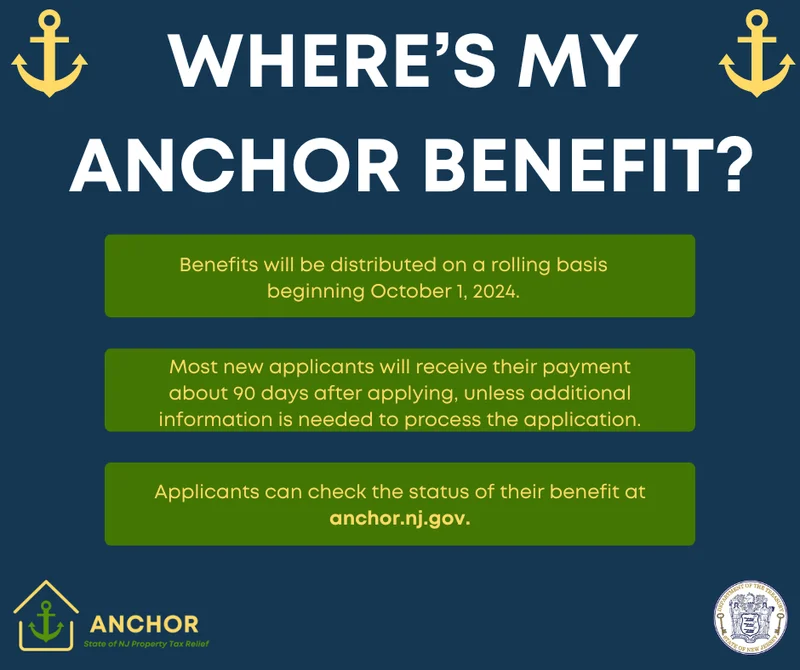

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)