Alibaba Stock: What's Driving the Price Today

Alibaba's Double Vision: Geopolitical Shadows and Surprising Technical Resilience

When a headline screams about a tech giant allegedly aiding a foreign military in targeting the U.S., you’d expect a full-blown market meltdown. For Alibaba Group Holding Limited (NASDAQ:BABA), the news dropped like a lead balloon, sending its shares tumbling. But if you’re only looking at the initial price action, you’re missing the deeper, more complex narrative playing out in the numbers. This isn't just about a stock falling; it's about how the market digests a geopolitical bombshell when the underlying asset has shown a remarkable ability to shrug off previous hits.

The immediate reaction was predictable. Alibaba stock saw a sharp pullback, down 4.73% to $152.31 at the time of publication on Friday. This happened after a Financial Times report, citing a declassified White House national security memo, alleged that Alibaba provided tech support for Chinese military operations. The memo, which the Times couldn't independently verify (an important methodological caveat, I might add), detailed access to customer data—IP addresses, WiFi information, payment records—along with various AI-related services, all supposedly for the People’s Liberation Army. Alibaba, naturally, called the allegations false, framing the information as a malicious leak designed to "malign the company." It's a classic he-said-she-said, but with national security implications that could make an analyst's hair stand on end.

The Curious Case of BABA's Bounce Back Potential

Now, here’s where my analysis diverges from the immediate panic. While the headlines paint a grim picture, the underlying technical data for BABA stock price tells a story of surprising resilience. We’re talking about a stock that, year-to-date, has shown an impressive 79.9% gain. That's not a typo—to be more exact, it's 79.9% before this latest dip. This kind of performance isn't built on sand; it suggests a fundamental strength or at least a powerful market conviction that has consistently brought buyers back in. I’ve looked at hundreds of these charts, and this particular juxtaposition of severe external shock against strong internal momentum is genuinely puzzling.

The Relative Strength Index (RSI) for Alibaba currently sits at 42.94. For those who aren't constantly staring at charts, that figure places the stock squarely in neutral territory—neither overbought nor oversold. It’s like a boxer who just took a heavy punch but is still standing firm, not wobbling on the ropes. The calculated support for Alibaba stock is at $130.06. That’s a key level, a potential safety net that could prevent a freefall if the selling pressure continues. On the flip side, resistance is identified at $170.55. If BABA can somehow regain momentum and push past that resistance, it would signal a profound return to bullish sentiment, effectively shrugging off these serious allegations. The proximity to the 50-day moving average also adds another layer of intrigue; a bounce off this level could be a rebound opportunity, while a break below could signal further weakness.

This situation feels like watching a high-stakes game of poker where one player just got dealt a terrible hand, but they've been winning all night. Do you bet against their streak, or do you assume they have a hidden ace? What's the market really pricing in here? Is it genuinely dismissing the national security implications, or is it betting on a quick resolution, perhaps a dismissal of the allegations as unverified noise? Or, more cynically, is the market simply too big, too liquid, and too focused on long-term growth stories from Chinese tech, like those that also drive Tencent or Baidu stock, to be truly swayed by geopolitical squabbles? How much of this resilience is genuine strength, and how much is simply the inertia of a massive institutional buy-in that takes more than a single report to unravel? We've seen similar patterns with other tech giants, from NVDA stock to Amazon stock, where short-term bad news often gets absorbed by long-term growth narratives.

Navigating the Data Crosscurrents

So, what does this mean for investors holding BABA? Caution is the operative word. While the year-to-date performance and neutral RSI suggest underlying strength, the gravity of the allegations cannot be ignored. This isn't just about quarterly earnings; it touches on trust, national security, and the increasingly complex relationship between global tech companies and sovereign governments. The market's initial reaction, a roughly 5% drop, seems almost muted given the severity of the claims. Is this a sign that the market has already factored in such risks for Chinese tech firms, or is it a dangerous complacency? The fact that the stock is still well within its 52-week range of $80.06 to $192.67 suggests it hasn't broken any critical long-term trends yet, but the path ahead is anything but clear. If you're looking at alibaba stock price today, as discussed in What's Going On With Alibaba Stock Today? - Alibaba Gr Hldgs (NYSE:BABA), you're seeing a snapshot of a battle between headline fear and technical fortitude.

The Geopolitical Discount Factor

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

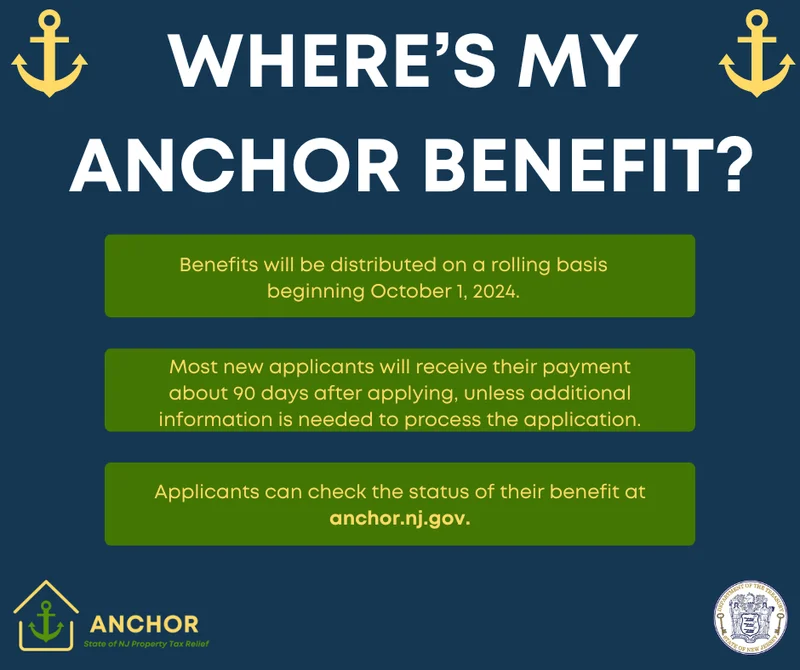

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)