Bitcoin: What the Shutdown's End Means for the $112K Forecast

An interesting pattern is emerging on the charts, one tied not to hashing power or on-chain metrics, but to the procedural votes of the U.S. Senate. Bitcoin has climbed over 4% to breach $106,000, and the narrative is clear: the 40-day government shutdown, a significant macro overhang, appears to be nearing its end. The market is pricing in a resolution.

This rally is predicated on two core assumptions. First, that an end to the shutdown will restore institutional confidence and unlock Treasury liquidity, a net positive for risk assets. Second, and more speculatively, that the resolution will be accompanied by a fiscal stimulus, a repeat of the 2021 playbook that sent capital flooding into crypto. Prediction markets reflect extreme confidence in the former, with platforms like Myriad and Polymarket assigning an 85-91% probability of the shutdown ending by November 15. The price action, however, seems more correlated with the latter. My analysis suggests the market is reacting to a story, and the data supporting that story is far from robust.

The Dividend Discrepancy

The primary catalyst for this recent surge wasn't the Senate vote itself, but a Truth Social post from President Trump promising a "$2000 a person" dividend from tariff revenue. You could almost see the buy orders light up the screen as algorithms and retail traders alike latched onto the news. It was a powerful echo of the stimulus checks that fueled the last major bull cycle. The market is acting like a Pavlovian dog, salivating at the sound of the "stimulus" bell, even if the Treasury Secretary is signaling the food bowl might contain tax-cut-flavored kibble instead of a juicy steak.

This is where the narrative begins to diverge from the facts. Treasury Secretary Scott Bessent quickly clarified the statement on national television, noting the "dividend" could simply manifest as tax decreases (a far less direct form of stimulus). This creates a significant discrepancy. While tax cuts can boost the economy, they don't inject liquidity with the same velocity as direct payments.

And this is the part of the analysis that I find genuinely puzzling. The market has largely ignored the Secretary’s clarification and continues to trade on the initial, more potent narrative. The historical precedent is powerful; after the 2018-2019 shutdown ended, Bitcoin rose over 265% in the following five months. Traders are clearly hoping for a repeat performance. But how much of this rally is pricing in actual, spendable cash in people's pockets versus the mere memory of the 2021 bull run? Is this a data-driven move or a sentiment-driven one?

Liquidity vs. Precedent

Setting aside the stimulus narrative, there is a more defensible, data-driven case for the rally. An end to the shutdown would, as Bitget’s chief analyst Ryan Lee noted, ease liquidity concerns and improve investor sentiment. It removes uncertainty. This is the quantifiable part of the equation. We can observe the liquidity clusters forming on the order books. The data from monitoring resource CoinGlass is clear: there is a significant block of ask orders sitting above the market, with the bulk of the liquidity resting between $111,500 and $115,000—to be more exact, the densest cluster appears right at $112,000. This is the next logical target for bulls, according to analysis like Bitcoin price eyes $112K liquidity grab as US government shutdown nears end.

This technical setup is supported by the historical parallel from January 2019. It’s a compelling data point, but one that requires careful scrutiny. The macro environment today is fundamentally different. In 2019, we were in a low-inflation, pre-pandemic world with a very different Federal Reserve posture. Today, as analysts like Shivam Thakral caution, risks of "sticky inflation, a stronger dollar, or renewed geopolitical tension" persist. These are not trivial variables when considering What’s Next for Bitcoin if US Government Shutdown Ends?.

The year-end price targets being floated are ambitious, ranging from $150,000 to Tiger Research’s $200,000 forecast. These figures are contingent on a perfect confluence of events: a shutdown resolution, continued Fed dovishness, and a smooth liquidity injection. It’s a possible outcome, but it’s far from a certain one. Is comparing the 2019 post-shutdown rally to today's market a valid historical parallel, or is it a classic case of confirmation bias, ignoring the radically different monetary landscape?

The Signal Is Weaker Than the Noise

My assessment is that the market is conflating two distinct events: the high-probability end of a government shutdown and the low-probability, high-impact event of direct stimulus checks. The current price action is being driven more by the noise of a social media post than the signal of actual fiscal policy. While the restoration of Treasury flows is a tangible positive, it hardly justifies the parabolic price targets being discussed. The real test for Bitcoin isn't whether Congress can pass a funding bill this week; it's whether the broader macro environment—inflation, Fed policy, global stability—will cooperate in the months to come. Right now, the market is pricing in the best-case scenario based on a flimsy narrative. That is not a data-driven strategy; it's a gamble.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

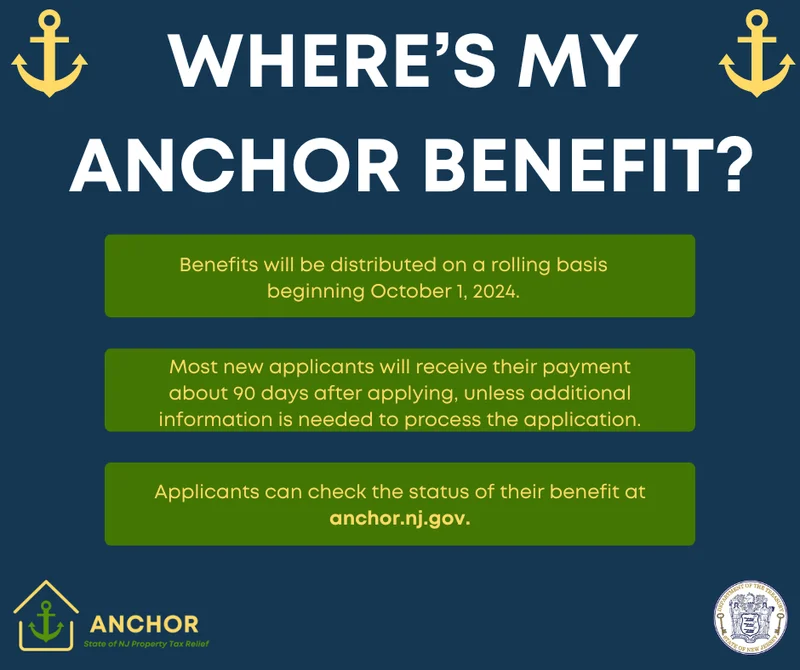

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)