The AI Debt Boom: Analyzing the Real Financial Risk

For the better part of two decades, the physical expansion of the digital world followed a simple, almost boring, formula. A tech giant like Google or Amazon, sitting on a dragon’s hoard of cash from search ads or e-commerce, would decide it needed more computing power. It would then write a check from its own deep pockets and a new, sprawling data center would rise from the plains of Oklahoma or the fields of Indiana. It was a capital-intensive but financially straightforward process, funded by realized profits.

That era is over.

A new gold rush is on, and the prospectors aren't the established titans. They're smaller, hungrier outfits, names you’ve likely never heard of, all racing to build the colossal server farms required for the artificial intelligence boom. But they aren't paying with cash. They're paying with debt. Tens of billions of dollars of it. This isn't just a change in funding; it's a fundamental shift in the risk profile of the entire tech ecosystem. We've gone from building on a bedrock of retained earnings to a foundation of leveraged hope.

The New Architecture of Risk

Let’s look at the numbers, because they tell the real story. Take CoreWeave, a New Jersey-based company that just went public. It has a deal to sell $14.3 billion in computing power to Meta. To fulfill this and other contracts, CoreWeave has disclosed a stark financial reality to its analysts: for every $5 billion in computing power it plans to build out, it must borrow $2.85 billion. That’s a leverage ratio of about 57%—to be more exact, 57 cents of every dollar spent on new infrastructure is borrowed money.

This isn’t the old model. This is a high-stakes game of financial arbitrage. These companies are effectively borrowing against the future demand for AI, a demand that, while currently white-hot, is based on projections that are still largely speculative. It’s like a real estate developer taking out a massive construction loan to build a skyscraper in a city that doesn't exist yet, all based on a consultant's report that people will definitely move there.

And this is the part of the analysis that I find genuinely concerning. We're not just talking about a few billion. We're talking about tens of billions—and if this model becomes the industry standard, it will quickly scale into the hundreds of billions across the sector. This debt is being used to acquire highly specialized, rapidly depreciating assets: thousands upon thousands of GPUs packed into warehouses. Unlike a traditional factory or a toll road, the economic value of a top-tier GPU can be cut in half in 18-24 months. What does that do to the collateral backing these massive loans? Are the lenders, caught up in the same AI euphoria, accurately pricing in that technological risk?

A System Built on Unseen Assumptions

The critical question isn't whether companies like CoreWeave can make money. In the current environment of insatiable demand, they almost certainly can. The real question is about systemic fragility. Who is underwriting this debt? And what assumptions are baked into their risk models?

When a bank lends money for a conventional data center, the risk is relatively understood. The asset has a diverse customer base and a long, predictable life. But these new AI facilities are different. Their value is inextricably tied to the bleeding edge of a technology that is evolving at a blistering pace. Imagine the hum of a brand-new data center in rural Virginia, every server rack filled with the latest NVIDIA chips, all financed with borrowed money. Now, what happens if a competitor announces a new chip architecture that is twice as efficient? The value of that entire facility—the collateral for billions in loans—could plummet overnight.

This introduces a new, correlated risk into the financial system. During the 2008 housing crisis, the underlying assumption was that home prices would never fall on a national level. What is the implicit, unquestioned assumption today? It seems to be that the demand for AI computing will grow exponentially, forever, and that the current hardware leaders will maintain their dominance.

I’ve looked at dozens of infrastructure financing deals, and the covenants are usually built around predictable cash flows and stable asset values. But how do you write a covenant for technological obsolescence? Are the credit rating agencies that bless this debt with investment-grade ratings truly equipped to model the pace of AI innovation? Or are they simply extrapolating the last 24 months of frantic demand into the infinite future?

This Isn't Tech, It's a Leverage Cycle

We need to stop thinking about this as just another chapter in the story of Silicon Valley. It’s a classic financial story. An exciting new paradigm emerges, capital floods in, and discipline erodes. The focus shifts from building sustainable businesses to capturing first-mover advantage at any cost, funded by other people's money. The AI boom is no longer just a technological phenomenon; it has become a vehicle for a massive, high-risk leverage cycle. And like all leverage cycles, the real danger isn't in the boom itself, but in the silent, accumulating risks that nobody is pricing in until it's far too late.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

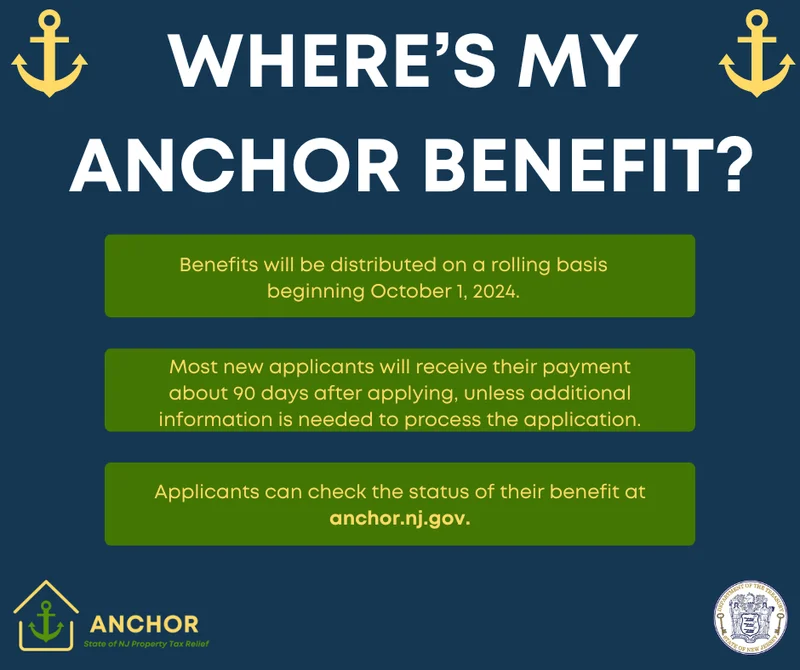

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)