Blue Owl: Capital, Stock, & Private Credit Dynamics

When Private Credit Goes Public: Blue Owl's Bait-and-Switch

Alright, let's talk about Blue Owl Capital, because what they just pulled off with their Blue Owl Capital Corporation II fund ain't just a "merger." No, 'merger' is the fancy corporate word for what feels a whole lot like a classic bait-and-switch, a move straight out of the old playbook: lure 'em in with the promise of private market exclusivity, then force-feed 'em public shares at a discount. It’s a cynical play, and honestly, I'm not surprised, but it still grates on my nerves.

You gotta hand it to them, it’s slick. On November 16, 2025, Blue Owl Capital Inc. basically slammed the door shut on investors trying to redeem their capital from Blue Owl Capital Corporation II. Why? Oh, because they're planning to "merge" that $1 billion fund into their much bigger, $17 billion OBDC fund. Sounds innocent enough, right? A bigger pool, more liquidity, all that jazz. But here’s the kicker, the part that makes my blood boil: after this "merger" closes early next year, those Capital Corporation II investors? They permanently lose the ability to cash out at Net Asset Value (NAV). Instead, they're getting publicly traded Blue Owl Capital Corporation shares. Publicly traded shares that, last I checked, are trading about 20% below the fund’s NAV. Twenty percent. Just poof, gone. This forced conversion, which effectively leaves some investors facing a 20% hit, is not a merger; it's a built-in haircut for the little guy.

The Shell Game: From Private Promise to Public Pain

I mean, can we just pause for a second and appreciate the sheer audacity? Blue Owl Capital Corporation II was one of their initial private debt funds, specifically designed for wealthy individual investors. It was sold as this exclusive club, a way to get into private credit, away from the volatility of public markets, with the promise of NAV redemptions. And now? Now those same investors are being kicked out of the private club and handed a ticket to the public market, but only after they've been stripped of a fifth of their potential value. It’s like buying a ticket to a VIP concert with a guaranteed refund if you don't like it, only to be told at the door, "Sorry, VIP's over, here's a general admission ticket for 80% of what you paid, and you can't get your cash back." You’re stuck. You’re just... stuck, watching your money evaporate because some suits decided it was more convenient for their balance sheet.

You know, I remember when `blue owl capital` first listed on the NYSE back in 2021. Big splash, lots of talk about democratizing access to private markets. And for a while, the `blue owl private credit` game seemed like a golden goose. But this latest move, it just rips the mask off. It shows you exactly who gets to win when these financial titans start reshuffling the deck. It's never the individual investor who thought they were getting a safe, steady return. The `blue owl stock price` took a hit too, dropping almost 6% to its lowest since December 2023. You'd think that would be a wake-up call, but for the folks who've lost 20% of their investment, a 6% dip in the parent company's stock is probably just a shrug.

The Aftermath and the Inevitable Legal Circus

Offcourse, the legal eagles are circling. Glancy Prongay & Murray LLP, a national shareholder rights law firm, wasted no time announcing a securities fraud investigation into `blue owl capital inc.` They're urging investors who lost money to contact them. And you know what? Good. Because someone needs to hold these guys accountable. This isn't just some minor accounting error; this is a fundamental breach of trust, a re-evaluation of the entire value proposition for holding private credit.

It makes you wonder, doesn't it? How many other `blue owl capital corporation` funds, or similar funds from other alternative asset managers, are going to pull this kind of stunt? The broader context here is that private credit funds are facing increasing scrutiny over their valuations. Publicly listed debt funds (BDCs) are already trading at significant discounts to their asset values. So, what Blue Owl's doing here isn't an anomaly; it's a symptom. It’s a loud, ringing bell telling us that the emperor of "private market access" might not be wearing as many clothes as we thought. Are we really supposed to believe that these "mergers" are always in the best interest of the original investors, or is this just a convenient way to shore up assets and avoid a run on the bank when the tide goes out on private credit? My gut says it's the latter.

I saw a guy on a forum the other day, talking about his `blue owl private credit fund merger` experience. He said he felt like he'd been sold a luxury car, only for the dealer to swap out the engine with a cheap, used one the moment he drove it off the lot. That's it, that's the feeling. The rug-pull. The moment of realization that the "exclusive opportunity" was just a trap waiting to spring. And honestly... I don't see this getting any prettier for the folks stuck holding those public shares.

The 'Private' Credit Trap.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

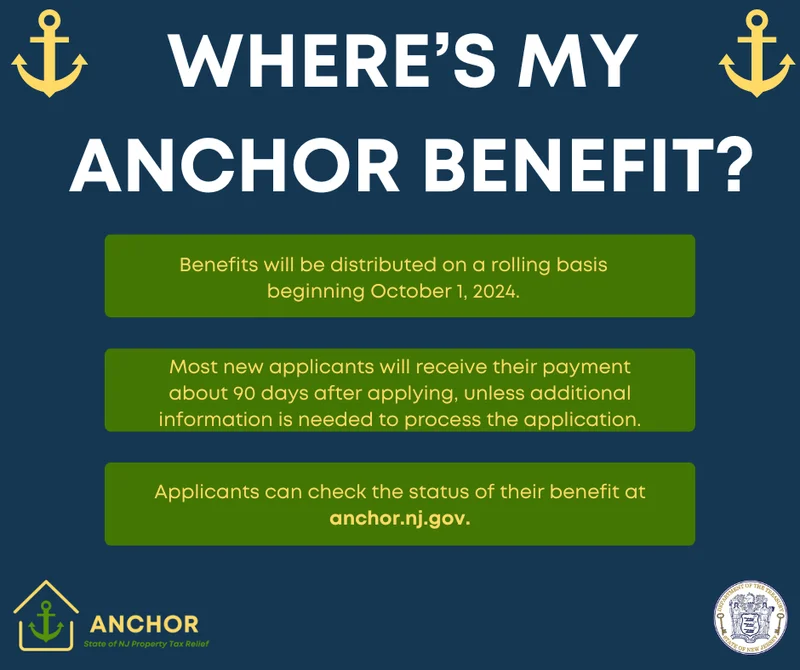

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)