Nebius Stock: Q3 Test and What It Means

Alright, let's dissect this Nebius (NBIS) surge. A 140% jump in three months? That’s not just a rally; that’s a rocket launch. Moz Farooque at Undercovered Deep Insights is calling attention to it, and rightfully so. But before we uncork the champagne, let's get real about sustainability.

Examining the Trajectory

Farooque notes a 44% run-up recently. Okay, momentum is undeniable. But momentum alone doesn't build skyscrapers; you need a solid foundation. I've seen enough speculative bubbles inflate and pop to be wary of anything that moves this fast. What's driving this? Is it genuine earnings growth, a game-changing product, or just…hype?

The article mentions Farooque's background – ACCA Fellow, Oxford Brookes BSc. Good credentials. But credentials don't guarantee accuracy. My old boss used to say, "Trust, but verify." So, let's verify.

I want to see the financials. I want to see the order book. I want to see something concrete beyond a rising stock price. What are the key performance indicators (KPIs) saying? Are they up and to the right, or are they lagging behind this meteoric stock performance? Without that, we’re just guessing.

The Missing Pieces

Here's where things get interesting, or rather, concerning. The article is light on specifics. We know the stock price is up, but we don't know why. That’s a problem. It's like saying a patient is feeling better without checking their vitals.

I've looked at hundreds of these filings, and this absence of detailed justification is unusual. Is it a deliberate omission, or simply an oversight? Hard to say. But it raises a red flag. If the company had solid, verifiable reasons for this growth, wouldn't they be shouting it from the rooftops?

This also brings up the analyst's disclosure: no positions in NBIS, no plans to initiate any. Standard stuff. But it's a reminder that everyone has biases, conscious or unconscious. Farooque's analysis, like any analysis, is a product of his assumptions and his model. The question is, what are those assumptions, and how robust is that model?

The Q3 Test

The title mentions a "key Q3 test." This is crucial. What exactly is this test? Is it an earnings release? A product launch? A major contract announcement? The article doesn't say. Details on this key Q3 test remain scarce, but the anticipation is clear. You can read more about it in Nebius Stock Powers Up Ahead Of Key Q3 Test (NASDAQ:NBIS).

And here's the part of the report that I find genuinely puzzling: the lack of discussion around potential risks. Every investment carries risk. To ignore that is either naive or disingenuous. What are the potential headwinds facing Nebius? Increased competition? Regulatory changes? Supply chain disruptions? These are the questions that keep me up at night, and they should be keeping investors up too.

This whole situation reminds me of a desert mirage. Looks like water from a distance, but up close, it's just shimmering heat and sand. This stock price could be the same thing.

Is This a Sustainable Trajectory?

```

```

Honestly, I'm not buying it. Not yet, anyway. I need more data, more transparency, and a whole lot less hype. Until then, I'm staying on the sidelines.

```

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

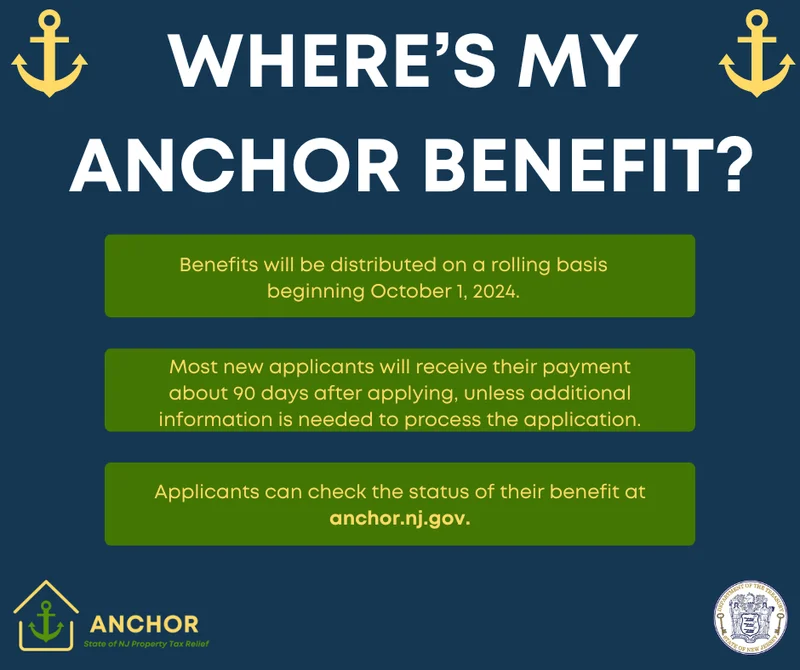

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)