China: What's Happening?

The Metaverse's Land Grab: Hype vs. Harsh Reality

The metaverse. The next iteration of the internet. A virtual world where you can work, play, and socialize. All buzzwords we’ve heard ad nauseam. But beneath the hype, there's a land grab happening. Virtual land, that is. And as with any land rush, the question is: are we looking at a goldmine or a fool's errand?

The promise is enticing: owning a piece of the future. Platforms like Decentraland and The Sandbox have seen virtual plots of land selling for millions (yes, millions) of dollars. Celebrities and brands are jumping in, snapping up digital real estate to build virtual experiences. It's easy to get caught up in the frenzy. The idea of owning a virtual property that could appreciate in value is, undeniably, alluring. But let's pump the brakes and look at the cold, hard data.

A Look at the Numbers

Transaction volume, for instance. While initial sales were astronomical, recent reports show a significant cool-down. We're talking a drop of, say, 80% in some platforms. That's not a gentle correction; that's a freefall. Now, proponents will argue that this is just a market finding its equilibrium. And maybe they're right. But I’ve seen this movie before with other speculative assets (dot-com stocks, anyone?). The initial surge driven by hype eventually gives way to a more sober assessment of actual value. (Remember Pets.com? I do.)

And this is the part of the analysis that I find genuinely puzzling: How do you even value virtual land? Traditional real estate has comparables—location, size, amenities. But in the metaverse, these metrics are, well, squishy. Scarcity is artificial. A platform can, at any time, decide to create more land. And what about foot traffic? A prime location in Decentraland is only valuable if people actually visit it. And are they? Anecdotal evidence from online forums suggests that many virtual properties are ghost towns. People bought the land, but nobody came.

The "Build It and They Will Come" Fallacy

The "build it and they will come" mentality is a dangerous one in any venture, but especially so in the metaverse. Owning a plot of land doesn't guarantee success. You need to create compelling experiences, attract users, and, ultimately, generate revenue. And that's where many projects are falling short. The user experience in many metaverses is clunky, the graphics are often subpar, and the content is, frankly, uninspired. It feels like the internet circa 1998.

Consider the cost of entry. Not just the cost of the land itself, but the cost of developing a virtual experience. Hiring developers, designers, and marketers can quickly eat into your budget. And even if you build something amazing, there's no guarantee that people will find it. The metaverse is a vast, sprawling space, and getting noticed is a challenge. It's like trying to open a lemonade stand in the middle of the Sahara.

One thing I will concede: there's potential here. The metaverse could revolutionize how we interact with each other and with brands. But the current iteration is far from ready for prime time. It's buggy, expensive, and lacks a clear value proposition for most users. And until these issues are addressed, the metaverse land grab will remain a high-risk, high-reward gamble. A gamble where the odds, right now, seem to favor the house.

A Very Expensive Beta Test

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

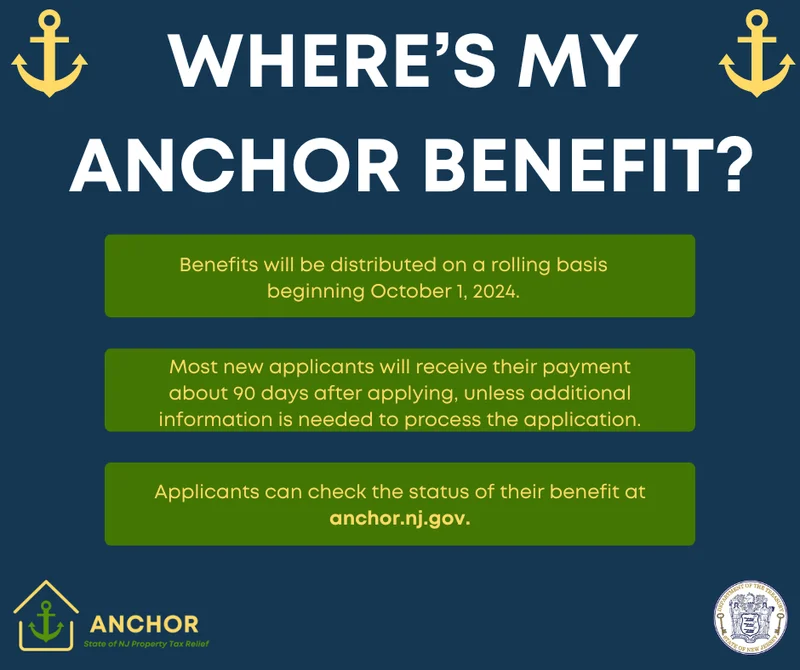

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)