Forge Global Acquisition: Schwab's Private Market Leap and What it Means for You

Schwab Buys Forge: A Glimpse Into the Democratized Future of Pre-IPO Riches

Okay, folks, buckle up. This Charles Schwab acquisition of Forge Global for $660 million? It’s not just another headline; it's a tectonic shift, a whisper of the future becoming reality. We're talking about access – access to the kind of wealth-building opportunities that, for decades, were locked away behind velvet ropes for the ultra-rich.

Think about it. For years, the hottest startups – the OpenAI's, the SpaceX's, the companies reshaping our world – stayed private longer and longer. Regular investors? We were stuck watching from the sidelines, waiting for the IPO, by which point, let's be honest, a huge chunk of the growth potential had already been realized. It's like being invited to the party after the cake's been cut and half the guests have already gone home.

This deal is about cracking open that vault. Schwab, with its massive reach and $11.6 trillion in client assets, is essentially saying, "Hey, you know those pre-IPO shares everyone's clamoring for? We're bringing them to you." And, let's be real, Morgan Stanley’s move to grab EquityZen last month? That just lit a fire under everyone.

The Walls Are Crumbling

Morningstar is calling it a "natural evolution" for Schwab, as they push further into private markets as investor demand continues growing. I think it’s more than natural; it’s necessary. As they pointed out, high-net-worth individuals currently allocate around 16% of their portfolios to alternative assets. But the real kicker? They're still lagging behind institutional investors by a whopping 900 basis points! That gap needs to close, and Schwab is betting big that it will. We envision a future in which 20%-25% of portfolio allocations to alternatives are commonplace for HNW investors.

And what does this mean for smaller investors? Right now, it seems geared towards RIAs and high-net-worth individuals. But the underlying trend is clear: the democratization of finance is accelerating. The walls between the "haves" and "have-nots" in the investment world are crumbling, brick by brick.

It reminds me of the printing press. Before Gutenberg, knowledge was carefully guarded, handwritten by monks, accessible only to the elite. The printing press unleashed information, empowering the masses. This Schwab-Forge deal, and others like it, are doing the same for investment opportunities.

Of course, with great power comes great responsibility. Access to pre-IPO shares is exciting, but it also comes with risks. These are often illiquid investments, and it’s crucial to do your homework and understand the potential downsides. We need to be smart, informed, and cautious as we navigate this new landscape.

But the potential upside? That’s what gets me truly excited. Imagine a future where everyday investors have the opportunity to get in on the ground floor of the next game-changing company, to participate in the wealth creation that has historically been reserved for a select few. The implications are huge. What new wave of innovation could be unleashed if funding comes from more diverse sources? What different kinds of companies might get funded?

The per-share deal value of $45 represents a premium of roughly 72% over the stock's last closing price. Shares of Forge Global surged 65% in premarket trading on the news. Charles Schwab to buy private shares platform Forge Global in $660 million deal This is more than just a financial transaction; it's a vote of confidence in the future of private markets and a recognition that the old ways of doing things are no longer sustainable.

A New Era of Financial Empowerment Dawns

This isn't just about money; it's about empowerment. It's about leveling the playing field and giving more people a chance to build a better future. I, for one, am thrilled to see it unfold.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

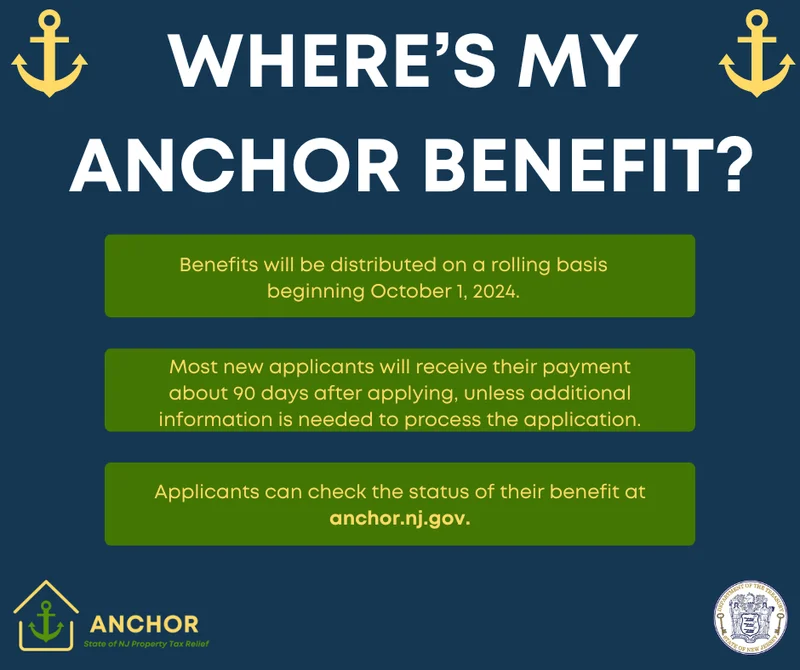

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)