DWP Christmas Bonus Shift: Eligibility and Payment Timeline

DWP's Christmas Bonus: A Festive Fiasco or a Fiscal Footnote?

The Department for Work and Pensions (DWP) is once again gearing up to distribute its annual Christmas Bonus. This year, as in years past, the lucky recipients will receive a one-time payment of £10. Yes, you read that right. Ten British pounds. Before we dive into the implications, let's clarify who actually gets this windfall.

Who Gets the £10?

According to official guidance, the Christmas Bonus goes to individuals receiving specific benefits during the first full week of December. This includes Carer’s Allowance, Personal Independence Payment (PIP), and Pension Credit, among others. Noticeably absent from the list: those relying solely on Universal Credit. So, while some vulnerable individuals get a tiny boost, others are left out in the cold. The payment, identifiable by the reference ‘XB’ or ‘DWP XB’ in bank statements, is automatically deposited, so at least there's no bureaucratic hurdle to jump. Claimants also need to be "ordinarily resident” in the UK, Channel Islands, Isle of Man or Gibraltar.

The real kicker? This £10 sum has remained unchanged since 1972. Let that sink in. In 1972, £10 could buy you a decent meal. Today, it might cover a couple of coffees – if you skip the fancy syrup. The Independent reports that this amount has degraded by over £100 due to inflation. That's not just a degradation; it's a near-total annihilation of its original value. I've looked at hundreds of economic policies, and this one is a particularly egregious example of policy inertia.

Payment Dates and Potential Chaos

Adding a layer of complexity, the DWP has confirmed that payment dates will shift this year. Given that Christmas Day (December 25th) and Boxing Day (December 26th) fall on a Thursday and Friday, respectively, payments typically scheduled for those days will be made on Christmas Eve (December 24th) instead. This is standard practice, but it inevitably leads to confusion and budgeting headaches for those living on the financial edge. DWP confirms payment dates will shift — Change affects beneficiaries waiting for Christmas money

The Office for National Statistics data indicates that nearly 40% of Britons have reported increased expenses for food, and 44% reported purchasing less food than usual due to higher food prices. A shifted payment date, while seemingly minor, can throw carefully balanced budgets into disarray. How many families will find themselves short on funds after Christmas, having spent their bonus and benefits earlier than anticipated?

The DWP emphasizes that this bonus payment will not affect other benefits and can be tracked by searching for “DWP XB” on your statement. However, if you haven't claimed your State Pension and aren't entitled to one of the other qualifying benefits, you won't get a Christmas Bonus. It is important to note that you should await final confirmation of the changes from the DWP, which is usually communicated in December.

The Ten-Pound Fig Leaf

Is the Christmas Bonus a genuine attempt to alleviate hardship, or is it merely a symbolic gesture? Let’s be brutally honest: £10 is barely a drop in the bucket for families struggling with rising food and energy costs. It's a public relations exercise disguised as social welfare. The real question is, why hasn't the government adjusted this payment to reflect inflation? What political calculus keeps this paltry sum frozen in time? Perhaps they believe any increase would open the floodgates to demands for broader benefit reforms.

Conclusion: A Holiday Illusion

The DWP's Christmas Bonus, while well-intentioned in its inception, has become a hollow tradition. It's a prime example of how a policy, once relevant, can become utterly detached from reality. The shifting payment dates add an unnecessary layer of complexity to the lives of those who can least afford it.

A Penny for Their Thoughts?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

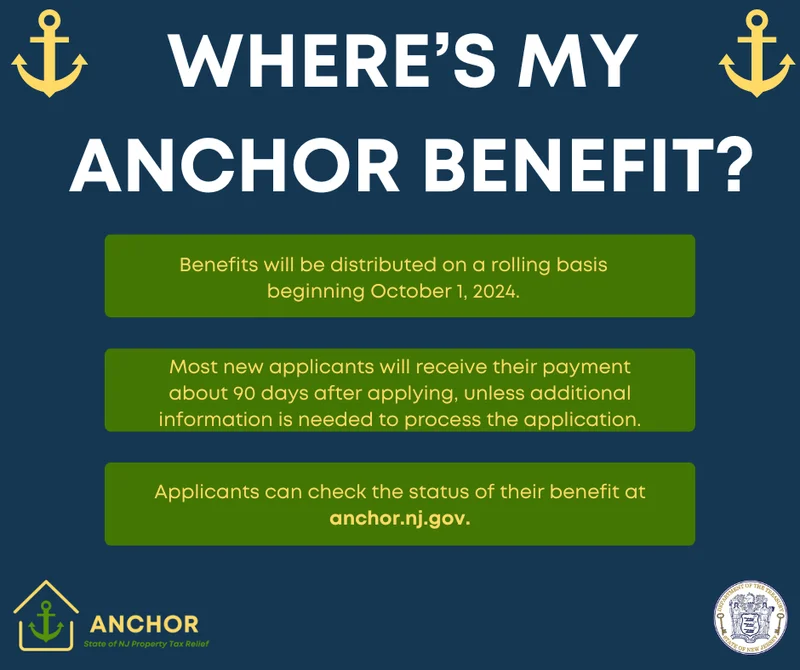

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)