Beldex: What We Know

Nvidia's AI Hype Train: Are the Numbers Real, or Just Really Good Marketing?

Nvidia. The name is synonymous with AI right now. But let's pump the brakes on the breathless pronouncements for a minute and look at the actual data. Everyone's talking about their dominance, but are we seeing genuine, sustainable growth, or a bubble inflated by AI hype?

The Revenue Surge: Impressive, But Is It Sustainable?

Nvidia's revenue growth has been nothing short of meteoric. We're talking about numbers that would make any CEO salivate. But let's dig a little deeper than the headlines. The data shows a massive spike coinciding precisely with the AI boom. Correlation doesn't equal causation, of course, but the timing is… conspicuous. The question is whether this demand is driven by real, long-term needs, or by a temporary frenzy to acquire AI infrastructure. I've seen these cycles before (dot-com bubble, anyone?), and they rarely end well for everyone involved. What happens when all these companies who are buying GPUs to train AI models discover they don't have a viable business model? Who's left holding the bag?

And this is the part of the report that I find genuinely puzzling. If you look at Nvidia’s customer concentration, a relatively small number of hyperscale cloud providers account for a significant chunk of their revenue. (The exact percentage isn't publicly available, frustratingly.) That means Nvidia's fate is heavily tied to the capital expenditure decisions of a handful of companies. If those companies decide to curtail their AI investments (perhaps due to disappointing returns), Nvidia's revenue stream could dry up faster than you can say "AI winter."

Beyond the Hype: Where Are the Real Profits?

Everyone focuses on revenue, but what about profit margins? Nvidia's gross margins are indeed healthy, but they're not immune to competitive pressures. AMD is nipping at their heels, and other players are entering the AI chip market. Increased competition inevitably leads to price erosion, and that's going to squeeze those margins. (A basic economic principle, but one often forgotten in the heat of a tech frenzy.)

It's not just about competition, either. The complexity of AI chips is increasing exponentially, which means higher R&D costs and more expensive manufacturing processes. Nvidia will need to keep innovating to stay ahead, but that comes at a price. Can they maintain their current profit levels while simultaneously investing in the next generation of AI technology? The question remains open.

So, What's the Real Story?

Nvidia is undoubtedly a powerful player in the AI space. Their technology is impressive, and their market position is enviable. But the current valuation seems to be pricing in near-perfect execution and continued exponential growth for the foreseeable future. That's a risky bet. I wouldn't short the stock just yet, but I'm certainly not chasing it at these levels. A healthy dose of skepticism is warranted. The numbers are impressive, but the narrative needs a reality check.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

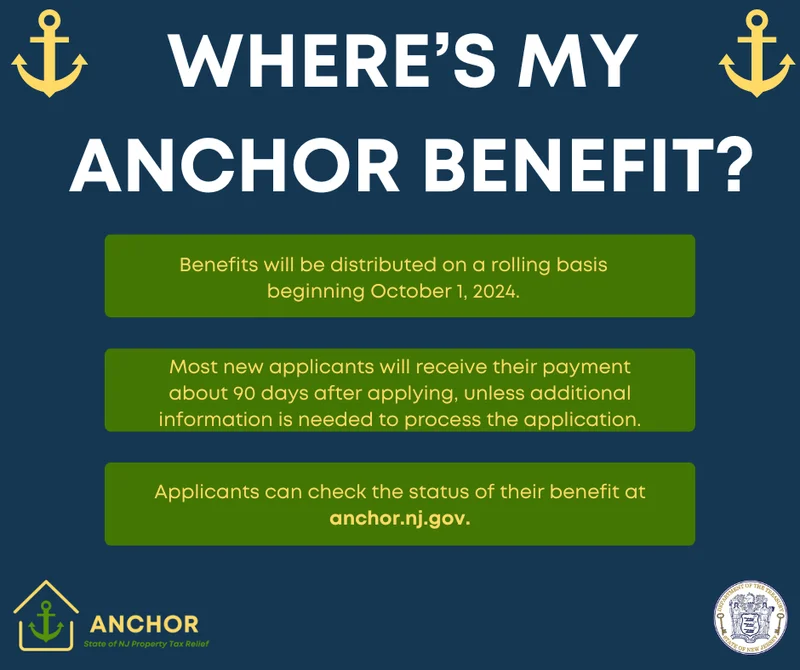

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

Zcash's Zombie Rally: The Price Prediction vs. What Reddit Is Saying

So,Zcashismovingagain.Mytime...

- Search

- Recently Published

-

- Blue Owl: Capital, Stock, & Private Credit Dynamics

- Switzerland: Time Zones, Major Hubs, & Key Logistical Data

- Cook County Treasurer: property taxes, bills, login, and how to pay

- Alibaba Stock: What's Driving the Price Today

- CoreWeave (CRWV): What's Driving Its Stock and Analyst Targets

- ANyONe Protocol: What it is and the real story

- Avicii: How AI is Continuing His Musical Legacy

- Bitcoin: What the Shutdown's End Means for the $112K Forecast

- The AI Debt Boom: Analyzing the Real Financial Risk

- Zcash's Historic Surge: Privacy, Potential, and What's Next

- Tag list

-

- carbon trading (2)

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (30)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (4)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)